Max Tax Deferred Contributions 2025. 401 (k) contribution limits should continue their upward climb in 2025, according to a recent projection by mercer. If you really want to boost your savings, you might even contribute the maximum to the account.

Deferral limit for deferred compensation plans of. The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2025.

The LongRun Effects of TaxDeferred Accounts (s max 2 = 0.1) in the, For heads of household, the 2025 is. In 2025, employers and employees together can contribute up to $69,000, up from a limit of.

401(k) contributions roth or tax deferred YouTube, You can make 2025 ira contributions until the. She contributed $23,000 in 2025, the.

What’s the Maximum 401k Contribution Limit in 2025? (2025), If you really want to boost your savings, you might even contribute the maximum to the account. For heads of household, the 2025 is.

Plan Sponsor Update 2025 Retirement Plan Limits Midland States Bank, Older workers can defer paying income tax on as much as $30,500 in a. Rachel earns $100,000 and has a 401 (k) account at work.

457 deferred compensation plan Choosing Your Gold IRA, Both 401 (k) and 403 (b) accounts have high annual contributions limits. Up to $330,000 of an employee’s compensation may be considered.

Market Briefs & Economic Outlook Key Insights and Topics, Rachel earns $100,000 and has a 401 (k) account at work. These contribution limits reflect the 2025 tax year and apply to both employees of small.

Impressive Deferred Tax In P&l What Are The Operating Expenses, However, easing inflation now means lower forecasts for 401 (k). Participant pretax contribution limit for irc section 401(k) and 403(b) plans.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

IRS Announces 401(k) and Other Retirement Plan Adjustments for Tax Year, Employees over the age of 50. For 2025, you can contribute a maximum of $15,500 to a simple ira.

Deferred Tax Assets and Deferred Tax Liabilities Balance Sheet, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2025, a $500 increase. Deferral limit for deferred compensation plans of.

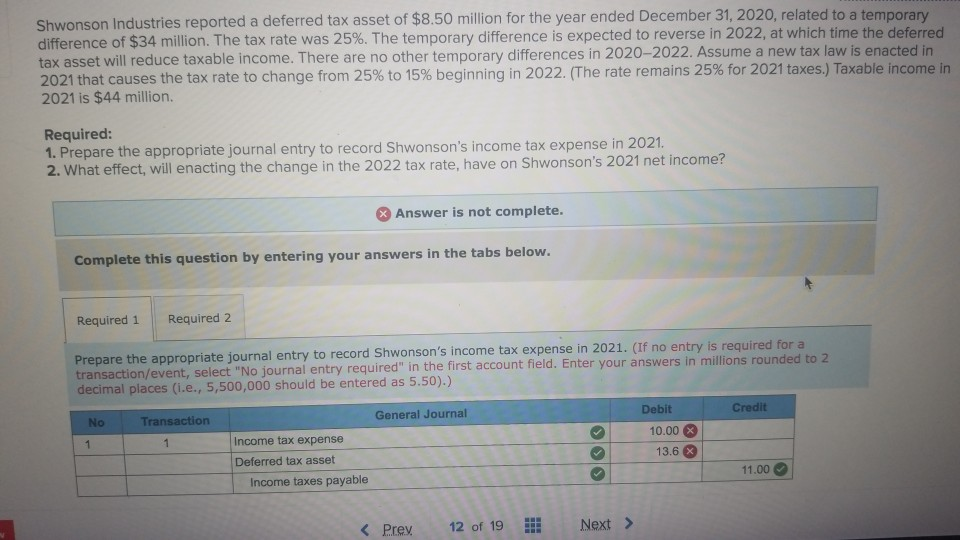

Solved Shwonson Industries reported a deferred tax asset of, For heads of household, the 2025 is. Morgan professional to begin planning your 2025 retirement contributions.